Will Technological Convergence Reverse Globalization?

2 Aug 2016

By TX Hammes for Institute for National Strategic Studies (INSS)

This article was external pageoriginally publishedcall_made by the external pageInstitute for National Strategic Studies (INSS)call_made, at the National Defense University (NDU) on 12 July 2016.

Key Points

- Numerous trends are slowing, and may even be reversing, globalization over the next decade or two.Manufacturing and services, driven by new technologies, are trending toward local production. For economic, technical, and environmental reasons, new energy production is now dominated by local sources—solar, wind, hydro, and fracked natural gas. To meet an increasing demand for fresh, organic foods, firms are establishing indoor farms in cities across the developed world to grow and sell food locally.

- Recent trade flow statistics indicate these factors have already slowed globalization. Technological and social developments will accelerate these inhibiting trends. Voters in the United States and Europe are increasingly angry over international trade. Prospects for passage of major trade agreements are dim. Authoritarian states, particularly China and Russia, are balkanizing the Internet to restrict access to information. Technological advances are raising the cost of overseas intervention while deglobalization is reducing its incentives.

- This paper argues that deglobalization would have momentous security implications. Accordingly, deglobalization must be monitored closely and if the trend continues, U.S. leaders will need to consider restructuring organizations, alliances, and national security strategy.

The Economist defines globalization as the “global integration of the movement of goods, capital and jobs,” and for decades, the process has been advancing. The combination of labor cost advantages, increasingly efficient freight systems, and trade agreements fueled globalization by providing regional cost advantages for manufacturing. Over the last six decades, it transformed agricultural societies into industrial powerhouses.

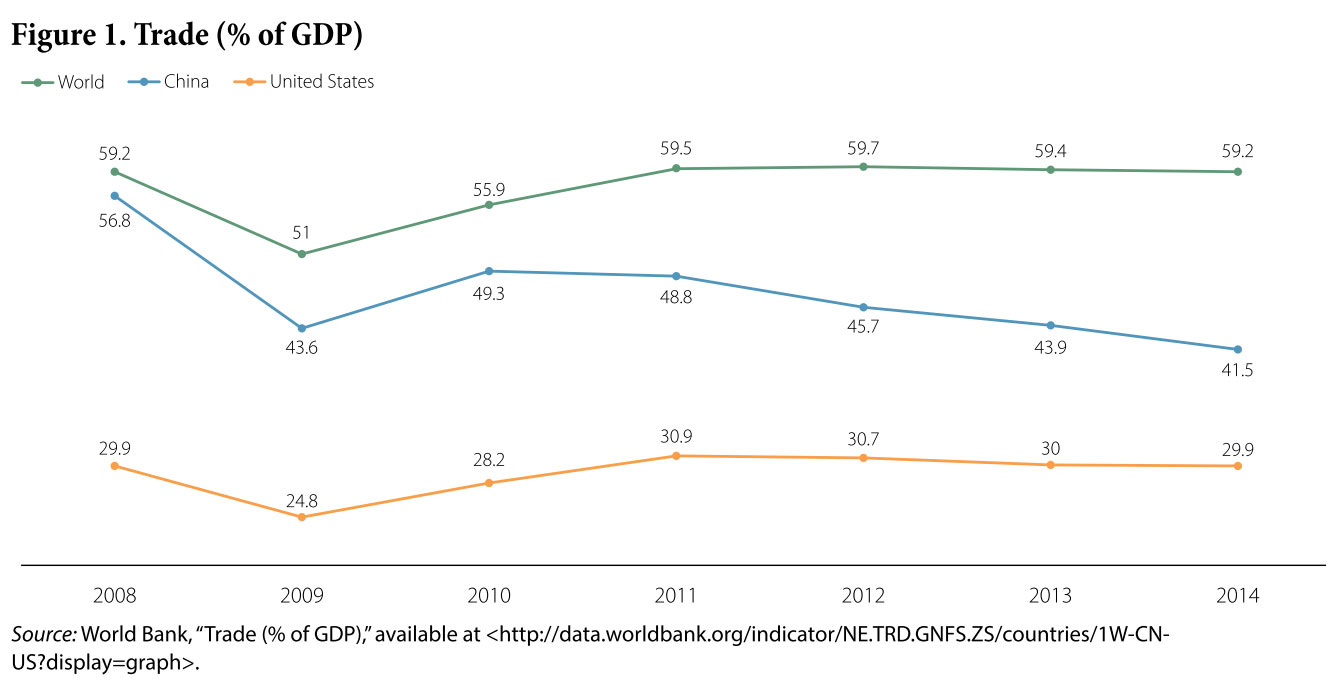

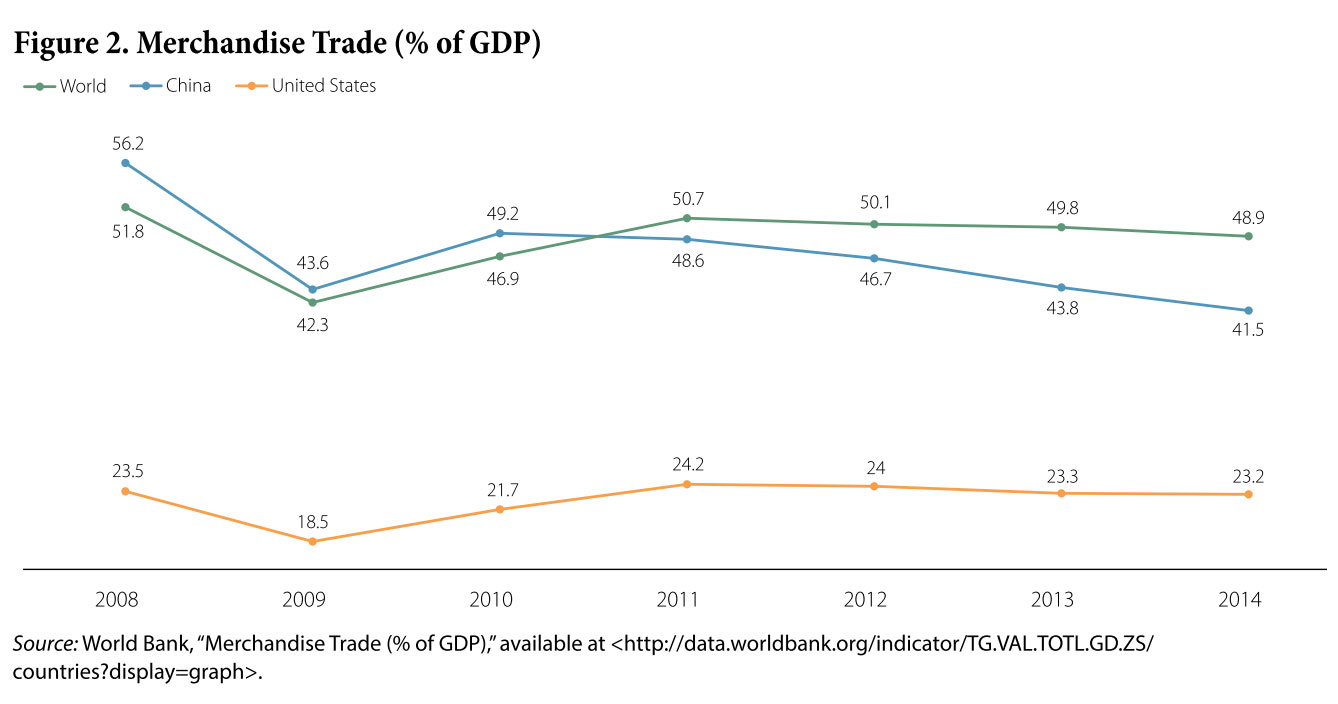

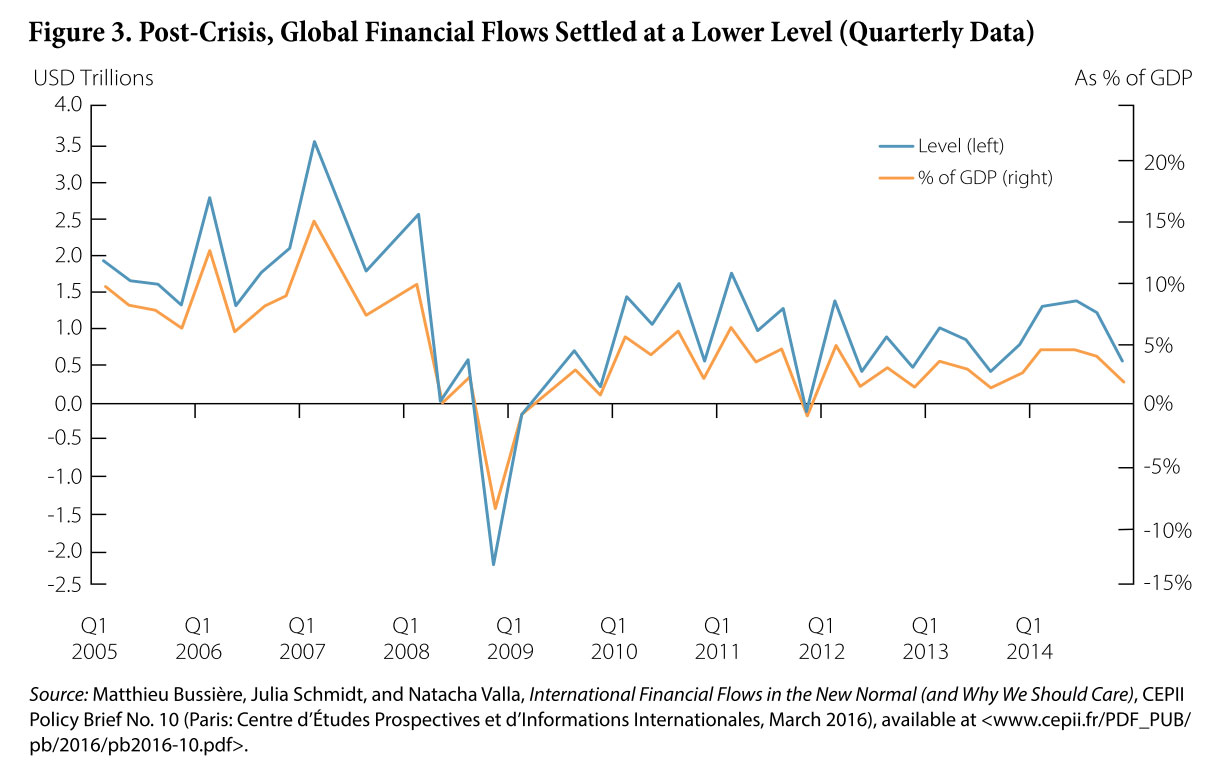

Then, the 2008–2009 global financial crisis—particularly the collapse of China’s demand for commodities—slowed global trade. This led to early speculation that a number of factors were slowing globalization. In fact, according to World Bank statistics, global merchandise trade as a percentage of gross domestic product (GDP) recovered relatively quickly from the 2009 crisis, almost reaching pre-crisis levels by 2011 (see figure 1). Speculation about slowing globalization ceased, even though trade as a percentage of GDP flattened and then declined from 2011 to 2014 (see figure 2). It was not just manufacturing; services followed the same pattern. Global financial flows also declined sharply following the crisis but did not recover (see figure 3): “The ‘Great Retrenchment’ that took place during the crisis has proved very persistent, and world financial flows are now down to half their pre-crisis levels. . . . Overall, net flows have fallen substantially relative to the years preceding the sudden stop.”

As recently as 2014, the Mackenzie Global Institute reported, “The network of global flows is expanding rapidly as emerging economies join in.” But by the time it produced its 2016 report, the institute had changed its tone, declaring that “after 20 years of rapid growth, traditional flows of goods, services, and finance have declined relative to GDP.”

Most analysts concluded that the reduction in trade was simply a cyclical downturn that would be reversed when China’s economy recovers. They predict globalization will resume and even accelerate. In contrast, this paper will argue that the convergence of new technologies will dramatically change how we make things, what we make, and where we make them. Trends in energy production, agriculture, politics, and the Internet will accelerate these changes, retarding, if not entirely reversing, globalization. Over the next decade or two, these trends will result in the localization of manufacturing, services, energy, and food production. This shift will change the international security environment.

How We Make Things

The combination of robotics, artificial intelligence, and three-dimensional (3D) printing is rapidly changing how we produce goods. The emergence of automated or “dark” factories that need only a few humans to supervise and maintain robotic production lines is a global trend. A fully automated factory in Mexico needs only six people per shift to produce thousands of cases of beer. The Changying Precision Technology Company in China has established an automated truck manufacturing plant that employees 90 percent fewer people. According to the Boston Consulting Group, about 10 percent of all manufacturing is currently automated, but this fi e will rise to 25 percent by 2025. Driving the trend is the dramatic decrease in the operational cost of robots. In electronics manufacturing, a robot costs only about $4 per hour for routine assembly tasks. In contrast, the cost of labor in China quadrupled in the last decade, now averaging about $4 per hour and continuing to increase rapidly. Robots have reached the economic crossover point at which they are cheaper than Chinese labor, and with China’s total labor force now declining, the robots’ cost advantage will only increase.

The world is on the cusp of the shift of labor to automation. Carl Frey and Michael Osborne’s 2014 report, “The Future of Employment: How Susceptible Are Jobs to Computerisation?” suggested that 47 percent of current jobs are at risk. The J.P. Gownder report, “The Future of Jobs, 2025: Working Side by Side with Robots,” is much less pessimistic but still forecasts a 16 percent loss of jobs to automation. Despite the range of estimates, all agree automation will have significant impact on how we make things. In fact, between 2010 and 2014, world industrial robot installations increased by 17 percent annually. In 2014, robot sales increased by a further 29 percent, with sales expected to reach 400,000 annually by 2018. This estimate does not account for the newly developed collaborative robots, or cobots, which are designed to work alongside humans rather than in a separate space. In effect, they are an assistant focused on increasing the efficiency of the supported worker. They are very new and represented less than 5 percent of global sales in 2015. But at an average cost of only $24,000, they will appeal strongly to the smaller companies that account for 70 percent of global manufacturing. A Price Waterhouse Cooper survey showed 94 percent of those chief executive officers (CEOs) who had already adopted robots say they increased productivity. Increased productivity, combined with reduced labor costs, makes the rapid adoption of these robots attractive even to small businesses.

Even as robots are changing traditional manufacturing, 3D printing, also known as additive manufacturing, is creating entirely new ways to manufacture a rapidly expanding range of products. The diversity of the products—from medical devices to aircraft parts to buildings and bridges—and the order of magnitude increase in the speed of printing are already challenging traditional manufacturing. Because it used to take days to print a part, 3D printing had been used primarily for prototyping and producing very high-value parts. That is changing rapidly. In a March 2015 TED Talk, Joseph DeSimone, CEO of Carbon3D, demonstrated the capability to print 100 times faster than usual; his goal is to print 1,000 times faster. In April 2016, his firm released the first commercial version of this machine. It reflects the lessons learned in production for Ford Motor Company, Johnson & Johnson, BMW, and others. DeSimone is not alone in seeking speed as well as higher quality. The Department of Energy’s Oak Ridge National Laboratory is partnering with Cincinnati Incorporated, a manufacturer of high-quality machine tools, to develop a process to print 200 to 500 times faster. The fact that key patents are expiring soon will further accelerate improvements in printer capabilities and capacities.

Commercial firms are taking advantage of these advances. United Parcel Service (UPS) has established a new initiative called “Direct Digital Manufacturing” focused on providing rapid 3D printing of any customer’s design. The managers of CloudDDM, the firm running the factory for UPS, state, “The fully-automated facility will house a staggering 100 3D printers which can be used to manufacturing one-off parts, or mass manufacture 1,000 of the same part. . . . The 3D printers found within this new facility all run 24 hours a day, 7 days a week, and require just three employees total; one per 8-hour shift.”

In addition, UPS and Staples are offering in-store 3D printing services at more than 100 stores nationwide: “UPS can see a major change coming. The concept is simple, local production of a vast number of components will hit the international shipping market hard.” This new method of manufacturing has three major advantages: it largely eliminates labor cost advantages through the removal of humans from the process, it reduces ship- ping time for finished products, and it eliminates most shipping costs.

Obviously, the key question is, how quickly will 3D capacity and capability increase? Price Waterhouse Cooper surveyed over 100 industrial manufacturers to determine their plans for 3D printing. Over two-thirds already use it, mostly for rapid prototyping, but over 10 percent are already using it for production. Also, investment in 3D printing is expanding at an exceptional rate. From 1987 to 2010, only $300 million was raised by 3D firms, about $12 million a year. From 2011 to 2015, over $4 billion had been raised, or about $800 million a year. The increased investment is paying off. In 2015, global spending on printers alone reached $11 billion, with projections of $29 billion by 2019. Fifty-two percent of the CEOs surveyed expect 3D printing to be used for high-volume production in the next 3 to 5 years. This is up from 38 percent only 2 years ago. Hewlett-Packard is betting its Jet Fusion process will compete with injection molding for the mass production of plastic parts. It will start shipping its $130,000 printers this October.

What We Will Make

To date, robotics has not had a major impact on what we can make. Robots have simply automated current production processes. However, 3D printing will have a major impact on manufacturing by bringing two other changes: mass customization and design for purpose. Since each print is guided by software, each individual product can be made different simply by selecting different options in the software. This will revolutionize the personal style and individual functionality of each product.

Printed clothing and shoes are moving from high- end individualized fashion to home-printed wardrobes. “Fast fashion,” the ability to quickly design, make, and deliver new styles to stores, is driving a significant section of the fashion industry. Yeh Group, a garment manufacturer, has teamed up with Loughborough University to design and create 3D-printed fashions that will be made “ethically, sustainably, and on-demand in 24 hours or less.” The clothing will be made to order yet will require dramatically less water and energy to produce. As the software is perfected and material base widened, all clothing may be made to individual order since there is practically no additive cost to customizing each product. Today, companies are even exploring the use of bio- printed leather to create belts and shoes.

Even as the 3D industry focused on prototyping and new design possibilities, a demand arose for limited production. As early as 2009, comedian Jay Leno saw an opportunity to make some non-metallic precision replacement parts for his antique automobile collection. He has exploited each improvement in 3D printing since and has moved to printing metal parts. Many enthusiasts followed his example and established an entire industry for 3D-printed custom parts. Leno notes that “with 3D printing, the automotive industry has changed more in the last decade than it previously did in the last century.”

As the technology improves, 3D printing is rapidly moving from prototyping to production. Years ago, Boeing took advantage of 3D printing’s unique capabilities to re-design a cooling duct for the F-18 Hornet, a strike fi already in military service for more than two decades. The duct was previously made of 16 separate parts that had to be laboriously welded together. The printed part is a single unit that is lighter, stronger, and optimized for air flow efficiency. Similarly, General Electric recently began using 3D-printed nozzles on its new LEAP jet engines. Rather than being assembled from 18 smaller parts, the new nozzle is printed as a single piece that is lighter, stronger, longer lasting, more efficient and cheaper.

The auto, truck, and aircraft parts industries have clearly seen the potential of 3D printing. Rather than stocking the wide variety of parts in the spectrum of colors and finishes they use, parts makers are maintaining only digital files and then printing on demand. Alcoa is already printing titanium fuselage parts for Airbus, and major manufacturers are developing the standards to certify a wider range of metal parts.

Aftermarket customization and retrofitting product updates are also sweet spots for 3D printing, and numerous other applications are being explored. Entrepreneurs across a variety of fields are exploring how 3D printing’s inherent trait of essentially free customization can be used.

Perhaps more revolutionary is the fact that, for the first time, designers can design an object to optimally fulfill its purpose. Current manufacturing techniques often require that optimal design be subordinated to manufacturing limitations. While the designer may have envisioned the most efficient form for a product, that form may be impossible to machine or build. Compromising design to account for manufacturing limitations results in lower operational efficiency and higher manufacturing costs. 3D printing frees the designer to create practically any form and see it printed to specification. In short, 3D printing can produce an expanding array of parts both faster and better than conventional manufacturing.

The use of 3D printing also allows designers and engineers to experiment with new techniques to increase strength and functionality. Honeycombed structures, such as those in bird bones, maximize strength for a given weight but have been very expensive and difficult to make with traditional manufacturing. And 3D printing can make them with relative ease. Furthermore, the process expands the possibility of using new alloys, including gradient alloys that expand the material properties of the product and increase the precision in production:

Gradient alloys would allow small amounts of one metal to be gradually overlaid with another in varying ratios creating a gradual transition from one metal or alloy to another. Stainless steel and aluminum for example cannot be welded together, but a structural component made of a stainless steel to aluminum gradient alloy could allow stainless steel and aluminum members to be joined without using fasteners.

Even more remarkable, 3D printing can actually improve the performance of existing materials. For instance, 3D-printed ceramics can have 10 times the compressive strength of commercially available ceramics, can tolerate higher temperatures, and can be printed in complex lattices, further increasing the strength-to-weight ratio.

Where We Make Things

By reducing labor costs while simultaneously increasing productivity and quality, these new technologies have brought some manufacturing back to the United States. Until now, the speed of this shift has been limited because, for the most part, these factories used expensive industrial robots that for safety reasons had to operate separately from humans. However, recent improvements in sensors and programming mean robots are evolving. We are seeing an accelerating shift to inexpensive cobots, which work alongside humans to increase human efficiency. This fact, plus the dramatic cost reductions, are leading to much wider employment of robots. They are moving beyond carefully structured assembly lines to performing cooperative tasks, shipping, stocking, and even selling. Robots driven by task-specific artificial intelligence will master more of the multitude of tasks involved in manufacturing, sales, and service.

The combination of robotics, artificial intelligence, and 3D printing is reducing the need for and cost advantage of cheap labor:

Increasing automation is likely to change the way companies evaluate where to open and expand factories. Boston Consulting expects that manufacturers will “no longer simply chase cheap labor.” Factories will employ fewer people, and those that remain are more likely to be highly skilled. That could lure more manufacturers back to the United States from lower-wage emerging market countries.

Thomas Roehmer, of the Massachusetts Institute of Technology Sloan School of Management, stated there are five good reasons to reshore manufacturing jobs: U.S. workers are 12 times more productive than Chinese workers, and the wage gap is narrowing quickly; more customers want both immediate gratification and made- to-order products; the learning curve within a company is much faster if all employees are located close together; the maker movement (3D manufacturing) is changing the competitive field; and energy costs are much lower in the United States. In fact, reshoring is happening today and will likely continue to increase in the future: “A 2013 survey by the Boston Consulting Group found that 54 percent of executives at U.S. companies with sales in excess of $1 billion are planning to return production to the [United States]. That figure is a sharp increase from the 37 percent of executives who said they were considering reshoring in a 2012 survey.”

The trends increased the following year. Boston Consulting Group shared the following findings from its fourth annual survey of U.S.-based manufacturing executives:

◆ A 17-percent increase in the number that reports they are actively reshoring now, which is 2.5 times the number actively reshoring in 2012.

◆ Thirty-one percent would put new capacity to serve the United States in the country versus 20 percent who would choose China—a reversal from 2 years ago, when China was favored 30 percent to 20 percent.

◆ Companies cite shortened supply chains and reduced shipping costs as the biggest reasons. Other reasons include workforce skill and control over process, quality, and innovation.

◆ Fifty-six percent believe that decreasing costs in automation have improved their product competitiveness.

◆ Seventy-one percent believe that advanced manufacturing technologies will improve the economics of localized production.

With the cost of labor no longer a significant advantage, it makes little sense to manufacture components in Southeast Asia, assemble them in China, and then ship them to the rest of the world when the same item can either be manufactured by robots or printed where it will be used. The future trends presaged in Boston Consulting Group’s survey are also reflected in the reversal of manufacturing employment trends over the past two decades. The United States lost manufacturing jobs every year from 1998 to 2009—a total of eight million jobs. But in the last 6 years, it regained about one million of them.

Another factor accelerating the shift of manufacturing back to the United States is the reduction in risk to intellectual property. Chinese firms are notorious for counterfeiting high-value products they are contracted to produce. One technique is for the Chinese contractor to build a duplicate factory identical to the one it builds to produce legitimate goods for a luxury brand. A simpler approach is to produce the agreed-upon number for the luxury firm and then, using the same production line, continue producing additional products for the counterfeit market. Despite major brand-name efforts to protect their intellectual property, the problem persists. China’s share of global manufacturing is 17 percent, but it is the origin of 84 percent of counterfeit or pirated goods. The problem does not end with counterfeiting. Showing great creativity, some of the Chinese firms hired to stop counterfeiting instead counterfeit themselves. Paid based on the value of counterfeit products they seize, some of the firms have set up their own factories to produce counterfeit goods, then present them as seized goods to collect big commissions. While taking production out of China will not stop counterfeiting, it will make it much more difficult and thus reduce the profit margin.

Collocation has other benefits. It reduces shipping costs and reduces—in some cases even eliminates—inventory. “Just in time” local production means no finished items need to be kept in stock, only a supply of input materials. A greater benefit of onshoring manufacturing is that it allows closer interaction between design and manufacturing. In a world used to frequent hardware upgrades, collocation accelerates those upgrades by speeding the “design, test, build, employ, improve” cycle. General Electric just finished building an Advanced Manufacturing Works right next to a large manufacturing plant both to take advantage of proximity and to learn more about how to maximize that benefit.

A trend in industries from fashion to cell phones to automobiles is rapid product cycles, and 3D printing has been a major factor in the first step—rapid prototyping—by greatly reducing the time needed to get the new product/part from design to prototype. As 3D printing capabilities continue to expand, it will speed the process all the way to production. Local Motors CEO Jay Rogers notes that with his company’s 3D-printed cars, “Model years cease to exist, products are developed 20 times faster.” Local Motors is able to fully print and assemble a car in 48 hours. An essential element of speed is the collocation of design and production facilities as well as easy customer input, since each car can be unique to that customer. Cost advantages will drive manufacturers to use 3D print technology, then use robotics to assemble and package products near where they are sold.

Hal Sirkin, an analyst with Boston Consulting Group, predicts that “you’re going to see more localization rather than more scale. . . . I can put up a plant, change the software and manufacture all sorts of things, not in the hundreds of millions but runs of five million or ten million.”

Nor will this trend be limited to developed economies. The cost of 3D printers, robotics, and artificial intelligence is dropping drastically. Printers vary from massive building-size units to ones the size of a microwave, but all have decreased in cost by at least 10 times in the last 5 years. Worldwide, more than 278,000 desktop printers (those costing under $5,000) were sold in 2015, up 75 percent from 2014. Metal printer sales are also growing at an exceptional rate, up 72 percent in 2013 and another 45 percent in 2015. Some firms are even producing small solar-powered printers, thus eliminating the requirement for a power grid and dramatically expanding the number and location of potential producers. China has reduced the price of a robotic arm to around $15,000, with a payback of investment in as little as 1.5 years. The bottom line is that an increasing number of products will be produced locally, which will steadily reduce the need for international trade in manufactured goods.

Because 3D printers build objects from the bottom up, they use material only where it is needed. Traditional (subtractive) manufacturing often starts with a block of material and carves it to create the object—and leaves a lot of waste. The material savings from 3D printing is particularly impressive “when using expensive materials like titanium, nickel-alloy steels, and thermal plastics.”

Return of Service Industries

Service industries are following suit as artificial intelligence (AI) takes over more high-order tasks. Call centers are already moving from low-wage areas to server banks. IPsoft.com’s home page leads with a counter that tracks the number of “Customer Incidents Addressed Without Human Intervention” (over 38 million as of April 2016). In his book The Master Algorithm, Pedro Domingos notes that outsourcers are aggressively advertising their bots with slogans such as “Greetings from Robotistan, outsourcing’s cheapest new destination.” Early adopters of AI-driven customer service centers like United Services Automobile Association have achieved very positive results. Pairing AI with humans has resulted in lower costs (fewer humans) and higher customer satisfaction.

Nor is artificial intelligence limited to routine call center tasks. The sophistication of artificial intelligence is growing so quickly that the Georgia Institute of Technology recently employed a software program it named “Jill Watson” as a teaching assistant for an online course. It did not tell the students until after they had submitted end-of-course critiques. All the students thought Ms. Watson was an effective and helpful teaching assistant; no one guessed she was a software program. Baker & Hostetler, a law firm, announced it has hired her “brother,” Ross, also based on Watson, as a lawyer for its bankruptcy practice.

Even as AI moves into sophisticated tasks, robotics will also take over mundane tasks such as delivery, stocking, cleaning, and so forth. Not surprisingly, Amazon is pioneering this effort. They have already created ware-houses where robots bring the goods to people who pick and pack them for shipping. Amazon is also sponsoring a contest to develop a robot that can take over the picking and packing and thus remove even more people from the warehouse. Since these services are provided locally, this move to automation will have little impact on globalization. However, it could reduce the number of low-paying jobs often taken by first-generation immigrants, thus reducing remittance payments globally.

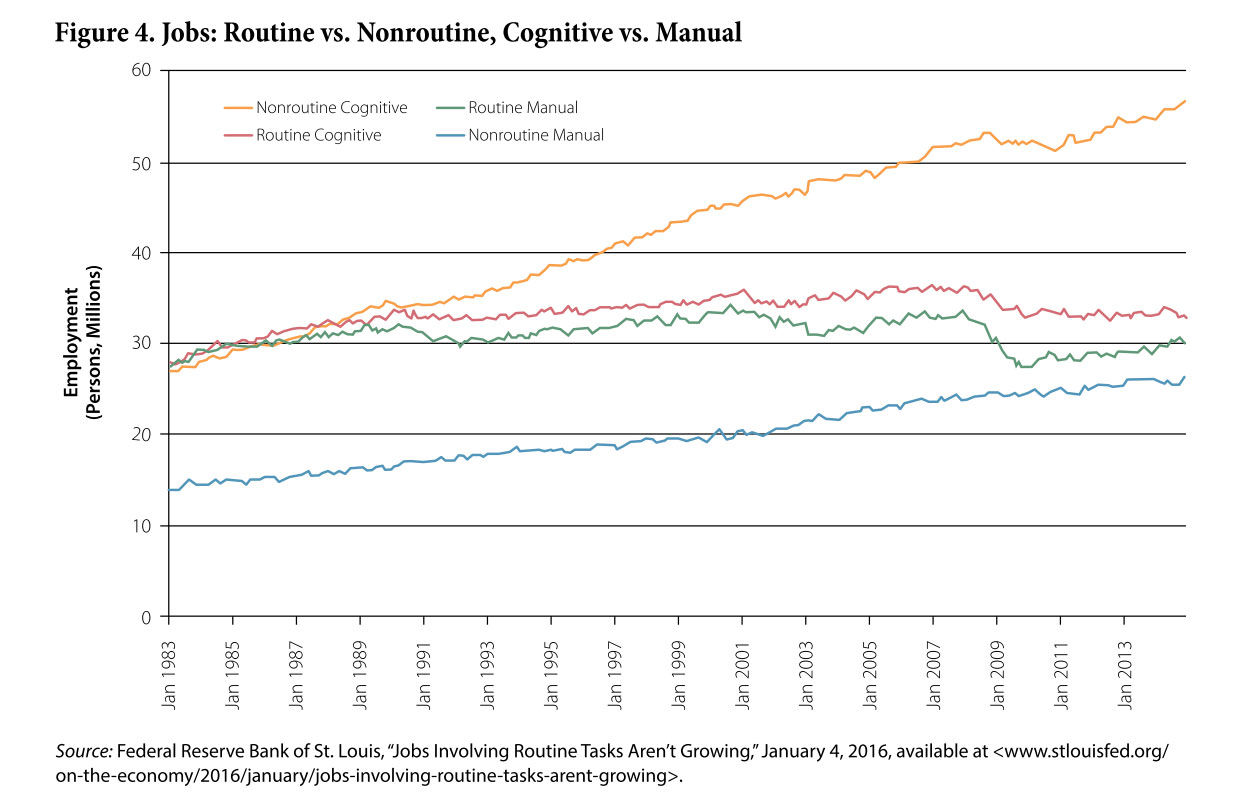

Many back office tasks will go the way of telephone operators and call center staffs. Service jobs that require the human touch or have to deal with non-routine tasks will remain, but a massive number of people will be replaced. Artificial intelligence is already handling tasks formerly assigned to associate lawyers and new accountants, reporters, radiologists, and many other specialties. In short, non-routine tasks, whether manual or cognitive, will still be done by humans, while routine tasks—even cognitive ones—will be done by machines (see figure 4). And this is not a new phenomenon; computer technology has been eliminating jobs since 1990.

With labor costs much less of an issue, better communications links, better infrastructure, more attractive business conditions, and effective intellectual property enforcement will encourage services to return to developed nations. The limited number of more complex questions that require human operators will be better handled by native language speakers who are intimately familiar with the local culture.

Only the First Step?

The changes in manufacturing and services may be only the first step in deglobalization. The reduced demand for transportation, alternative energy technologies, and increased energy efficiency will reduce the global movement of coal and oil. While starting from a small base, renewable energy is growing very rapidly. Wind, solar, thermal, and hydro power are locally produced and growing rapidly. In 2014, renewables made up 58.5 percent of net additions to global power systems. In 2015, 68 percent of the new installed capacity in the United States was renewable. Energy from renewable sources can be traded across adjacent borders but not globally. Even more important for the United States, fracking means less expensive natural gas is replacing coal and oil for generation of electricity. As hybrid and all-electric vehicles improve, the source of transportation energy will move from petroleum to electric energy. Fracking, alternative energy, and new efficiencies have already dramatically reduced the U.S. need for imported energy. If other nations can make similar advances in these areas, large segments of the energy market will become local. Growth in these energy sources will slow and perhaps eventually reverse the global trade in gas and oil.

Agriculture is another area that has seen increased global trade over the last few decades. High-value fruits, vegetables, and flowers move from nations with favorable growing conditions to those without. However, indoor farming has begun to undercut this trade by providing locally produced, fresher, organic products. A facility in Tokyo produces 30,000 heads of lettuce per day in only 25,000 square feet—less than half a football field—and is building another all-robot operation. Within 5 years, this second operation plans to produce 500,000 heads of lettuce daily. Now that the concept has been proved, Japanese electronics firms are putting their unused factories into food production. “According to the Japanese Ministry of Economy, Trade, and Industry, Japan currently has about 211 computer-operated plant factories—hydroponic and aeroponic farms growing food in closed environments without the utilization of sunlight.”

The industry is not restricted to Japan. A firm in the United States is planning to establish 75 indoor factory farms. Growing Underground is exploiting the concept in London. The German firm INFARM places small, vertical farms inside supermarkets to allow shoppers to pick garden-fresh herbs. Similar urban farms are being built across Europe and Russia. Depending on the product, such farms can produce 11 to 15 crop cycles per year.

In addition to meeting the growing demand for fresh, local produce, these farms may gain a cost advantage. They do not require herbicides or pesticides, use 97 percent less water, waste 50 percent less food, use 40 percent less power, reduce shipping costs, and are not subject to weather irregularities. On a larger scale, these processes will seriously reduce the market for long-range shipping of high-value agricultural products. It is less clear whether bulk products such as grain can be farmed using the same techniques. However, Japanese firms are growing rice in a number of their facilities.

Cultured (vat-grown) meat will also have an effect on global trade. Currently in its infancy, cultured meat remains expensive and of inferior quality. But the fact that it has been done and is steadily improving in taste and texture changes the nature of the problem. It is no longer a question of biological feasibility but rather of engineering and production. Moreover, proponents state that it takes 95 percent less water, 98 percent less land, and 45 percent less energy and produces 95 percent less greenhouse gases to grow a pound of cultured meat compared to growing it on the hoof. Cultured meat will not require antibiotics and will be produced in a much more sanitary environment than current processes.

Almost all predictions show meat consumption increasing globally over the next couple of decades. The U.S. market for meat and poultry alone was $186 billion in 2014. The growing global market will provide a massive financial incentive to master the production of cultured meat. When it succeeds, it will reduce the import/export not just of meat products but also of the agricultural feed products necessary to raise animals. The top five soybean exporters shipped a total of over 60 million metric tons in 2015, most of it as animal feed.

All the factors listed above will be reinforced by social pressures to “buy local” and by the desire to reduce the environmental impact of production. Local manufacturing production both creates jobs near the consumer and dramatically reduces transportation energy and packaging waste. Indoor farming can almost eliminate the environmental impact of farming on land and water-ways. The growing movements to restrict fertilizer use in major drainages (for example, the Chesapeake Bay) will add to pressure to change how we grow food. Cultured meats will not only greatly reduce the environmental footprint of the meat industry but will also appeal to the growing animal rights movement.

A further driver of fragmentation is the effort by authoritarian governments to segment the Internet. In his book Splinternet, Scott Malcomson notes that

when the web took off in 1995 Russia and China started saying they wanted “more control over our particular parts of it.” They have been trying to gain that control ever since. The U.S. response to those attempts was not a universal one but a national one, calling on American companies to provide special access for American government agencies, not foreign agencies. In terms of the once universal web this was simply an admission of defeat. . . . The United States did not intend to help fragment the web into national spheres of interest, but that is what happened.

Initially considered an impossible goal, China has steadily improved its ability to control what people can access inside its territory:

What China calls the “Golden Shield” is a giant mechanism of censorship and surveillance that blocks tens of thousands of websites deemed inimical to the Communist Party’s narrative and control, including Facebook, YouTube, Twitter and even Instagram. In April, the U.S. government officially classified it as a barrier to trade, noting that eight of the 25 most trafficked sites globally were now blocked here. The American Chamber of Commerce in China says that 4 out of 5 of its member companies report a negative impact on their business from Internet censorship.

Yet there is to be no turning back. Later this year, China is expected to approve a new law on cybersecurity that would codify, organize, and strengthen its control of the Internet.

China considers “Internet sovereignty” a legitimate aspect of a state’s control of its own territory. Other authoritarian governments are obviously both interested in and experimenting with these techniques. Totalitarian nations have decided the costs of connectivity exceed the benefits of globalization. Restricted access to the Internet will inevitably reduce these nations’ participation in the global economy. The revelation by Edward Snowden that the United States was exploiting the connectivity for intelligence provided additional incentive for these nations to restrict the Internet.

Cumulative Effects

With the exception of tighter control of the Internet, each of these technologies will result in better products for less money and will decrease the volume of international trade. The key question is, how much will globalization decrease from the sum of shifts in manufacturing, automation of services, localization of power, and food production?

The most frequently expressed economic concern about the convergence of robotics and artificial intelligence is about the elimination of jobs. Today, the cost of a robot is about the same as one year’s labor in low-wage countries (noting that robots work around the clock). It makes sense to replace even cheap labor with robots. Thus, it makes increasing economic sense for many nations to onshore production. These factories and service centers will create some new, better paying jobs. Unfortunately, many more jobs will simply cease to exist: assembly line workers, warehouse workers, drivers, and many others.

Just as significant as the loss of jobs is the real possibility that these changes will slow or even reverse globalization. Localizing production will dramatically reduce traffic in components and finished manufactured products, thus disrupting established trade patterns. Currently, we ship raw materials to one country, where workers put together the sub-assemblies, pack them, and ship them to another country for assembly and packaging. This second country then ships the packaged product to the consuming country. With the emergence of 3D manufacturing, we will ship smaller quantities of raw materials to a point near the consumer, produce them, and then ship them short distances for consumption. In many fields, such as medical supplies, the products may well be printed on site, thus further reducing packaging and shipping. In short, manufacturing becomes local. Further reducing global trade is the localization of energy production and return of high-value agriculture to developed nations.

Other factors may further slow globalization. First, protectionism is growing. Since 2008, more than 3,500 protectionist measures have been instituted globally, as well as numerous additional administrative requirements that increase the difficulty of international trade. These include an increasing number of countries passing laws requiring their governments to purchase locally produced products, even if they are much more expensive than imported alternatives. As robotics, AI, and 3D printing eliminate jobs, the political pressure for protectionism will rise. The pressure will be reinforced by the global overcapacity in many industries, such as steel. To prevent dumping, nations are already raising import duties.

Political campaigns in the United States and Europe reveal the growing popular opposition to international trade. While the Trans-Pacific Partnership has been negotiated, it has not received congressional approval. Further, Republican Presidential candidate Donald Trump has repeatedly expressed opposition to it, and Democratic Presidential candidate Hillary Clinton has recently reversed her position and now opposes the treaty. It is unlikely to pass in this contentious election year. The Atlantic counterpart, the Transatlantic Trade and Investment Partnership, is still being negotiated but faces rising domestic political opposition on both sides of the Atlantic.

For undeveloped nations, the convergence of these technical and social trends may block the path to industrialization. Without the cost advantage of inexpensive human labor, these countries will not be able to follow the path to prosperity taken by Japan, Korea, and China:

Countries such as Indonesia are already suffering from something that Harvard economist Dani Rodrik has dubbed “pre-mature de-industrialisation.” This describes a trend where emerging economies see their manufacturing sector begin to shrink long before the countries have reached income levels comparable to the developed world. Despite rapid economic growth over the past 15 years, Indonesia saw its manufacturing industry’s share of the economy peak in 2002. . . . Rodrik believes the country will never be able to grow at the kind of rapid rate experienced by China or South Korea. “Traditionally, manufacturing required very few skills and employed a lot of people,” he says. “Because of automation, the skills required have in- creased significantly and many fewer people are employed to run factories.

The resultant lack of economic opportunity in conjunction with youth bulges in many of these nations will have major social and security impacts. Both internal instability and economic migration are likely to increase.

Implications

Immediately following the 2008 financial crisis, there was speculation that globalization might have peaked. The next 3 years of slow but fairly steady economic recovery buried such speculation. In fact, the recent flattening of international trade and global flows could simply be a pause on the way to further globalization. Or it could be a harbinger of a major structural shift in international economics. Analysts must continue gathering data to determine which outcome is more likely, which will not be easy. The changing global economy has left economists struggling to measure it. The Economist recently noted that GDP is a poor measure of prosperity and not even a reliable gauge of production. Compounding the questionable utility of GDP statistics, much of the new economic activity is poorly measured using current methods. Thus, even as we gather data, prudent planning requires considering deglobalization as an alternative future when formulating economic, diplomatic, and military policies. The implications of globalization reversing reach across America’s economic and security futures.

In his book Economic Interdependence and War, Dale C. Copeland observed that economic power is the real source of military power and that, in modern times, economic power has been built on the international division of labor. This created a dilemma for policymakers. Trade, while essential to economic growth, created a dependency on other nations and therefore a security vulnerability; witness the oil crises since the 1970s.

However, the United States is well positioned today to change that relationship. North America is essentially self-sufficient in food production and soon will be the same in energy. It is a world leader in robotics, artificial intelligence, materials science, and 3D manufacturing. As a result, the United States is already seeing an increase in reshoring of manufacturing. Intellectual property rights backed by a relatively transparent legal system and the world’s largest demand also make the United States an attractive location for services as they move from cheap labor to cheap automation. Thus, deglobalization may solve the dependency dilemma for the United States.

This has major implications for national security. First is the potential for isolationism among the American people. While the assumption that global trade is good may still exist among policymakers and economists, it is rapidly fading among the general population. In 2002, Pew Research found that 78 percent of Americans supported global trade. By 2008, support had fallen to 53 percent. In 2014, when Pew changed the question from whether trade was good for the nation to whether trade improved the livelihood of Americans, favorable ratings plunged. Only 17 percent of Americans thought trade led to higher wages, and only 20 percent believed it created new jobs. Even the U.S. International Trade Commission is not particularly enthusiastic about the economic boost that might come from the Trans-Pacific Partnership. It estimated that, if ratified, the partnership would lift U.S. gross domestic product by only 0.15 percent. Such meager trade benefits will not do much to sway a Congress sensitive to popular opinion.

In terms of security strategy, developments across robotics, 3D manufacturing, nano-explosives, and artificial intelligence are changing the military balance of power by making stealthy, long-range precision strikes by air and sea increasingly available to small powers and even insurgent groups. Additive manufacturing will make these systems inexpensive and numerous. Thus, force projection will be much more difficult, with the potential for high U.S. casualties.

In these conditions, the American public may demand a return to a limited strategic concept of defending the hemisphere and assuring access to the global commons. This implies a significant shift to maritime, air, space, cyber, and electronic warfare capabilities and away from ground forces. The U.S. military’s primary mission may revert to the punishment of bad behavior rather than attempts at intervention to stabilize a region.

This would represent a major change to U.S. policy. Since 1945, the United States has pursued globalization for both economic and security reasons. The burdens of U.S. leadership in safeguarding international norms and free trade were justified as necessary to preserve national prosperity, a view that remains prominent among U.S. foreign policy and national security elites. For example, ten leading practitioners recently concluded:

The best way to ensure the longevity of a rules-based international system favorable to U.S. interests is not to retreat behind two oceans. . . . The proper course is to extend American power and U.S. leadership in Asia, Europe, and the Greater Middle East—regions where threats to the international order are greatest and where either new approaches or more consistent application of time-honored approaches are most urgently needed.

However, for economic and domestic political reasons, whichever party wins the next election will likely encourage each of the trends discussed in this paper with tax breaks, trade policy, and administrative actions. Popular opinion supports reshoring of U.S. industry, which means encouraging robotics, 3D manufacturing, and artificial intelligence. Local energy production greatly improves our balance of payments, brings petrochemical-based industries back to the United States, reduces damage to the environment, and provides energy security. Indoor factory farming reduces the use of energy, water, pesticides, and herbicides as well as reducing transportation costs. Thus, the cumulative effect of supporting current trends, which may be irreversible in any case, will be to discourage and undermine the case for globalization while potentially strengthening the U.S.-Canada-Mexico trading bloc. Similar pressures may drive nations across the globe to similar regional trade blocks.

In turn, if globalization no longer has major economic benefits for the United States, then employing U.S. power in an effort to maintain global security will be seen purely as a cost. This will create a very different domestic environment for the practice of U.S. foreign policy. Deglobalization will reduce Americans’ interest in propping up global stability at exactly the time the widespread dissemination of cheap smart weapons will significantly increase the costs of doing so. Faced with growing social and infrastructure needs, Americans may no longer be willing to underwrite international security with their tax dollars. It will be difficult to continue to convince Americans to spend heavily to defend Europe when 300 million Europeans are spending on social programs instead. The same attitude will extend to Asia, where most allies spend well under 2 percent of their GDP on defense; even Korea spends only 2.6 percent compared to the 3.5 percent spent by the United States.

Our allies in Europe and Asia already believe U.S. resolve is wavering. A lean toward isolationism will have a dramatic effect on our alliances. The European nations of the North Atlantic Treaty Organization would no longer be able to assume the United States will guarantee their security regardless of how poorly they provide for their own defense. Of more concern, our allies in Asia may feel a need to procure nuclear weapons if they believe U.S. commitment to the security of Asia is weakening.

Summary

The convergence of new technologies has been referred to as the 4th Industrial Revolution. Klaus Schwab, founder and executive chairman of the World Economic Forum, writes, “The speed of the current breakthroughs has no historical precedent. When compared with previous industrial revolutions, the Fourth is evolving at an exponential rather than a linear pace. Moreover, it is disrupting almost every industry in every country. And the breadth and depth of these changes herald the transformation of entire systems of production, management and governance.”

Previous revolutions took many decades; this one will be much faster. It will unfold over the next few decades, bringing amazing advances in manufacturing and services. Like the previous revolutions in means of production, there is no doubt the global economy will change in many ways. Robotics, artificial intelligence, 3D printing, indoor farming, renewable energy, and even meat production all seem to be moving to localized production. The net effect is slowing, and possibly even reversing, globalization. The economic implications for the United States are mostly positive. The security implications are debatable but certainly momentous. Clearly, the basic assumptions undergirding 60 years of post–World War II grand strategy would have to be reconsidered. Deglobalization trends must be monitored closely and if they continue, U.S. leaders will need to consider restructuring organizations, alliances, and national security strategy.

About the Author

Dr. T.X. Hammes is a Senior Fellow in the Center for Strategic Research, Institute for National Strategic Studies, at the National Defense University.