The Southern Gas Corridor: Challenges to a Geopolitical Approach in the EU´s External Energy Policy

17 Mar 2017

By Marco Siddi for Finnish Institute of International Affairs (FIIA)

This article was external pageoriginally publishedcall_made by the external pageFinnish Institute of International Affairs (FAIIA)call_made in March 2017.

- Natural gas is considered an important component of the EU energy mix, both as a replacement for more polluting fossil fuels and as a back-up for intermittent renewable energy production. However, declining domestic production has led to an increase in EU import dependency on gas.

- After the Ukraine crisis, the EU has become wary of energy interdependence with Russia, its main external supplier. This led the Union to accelerate the integration of its internal gas market and to support new pipeline projects, most notably the Southern Gas Corridor (SGC).

- The SGC will transport Azeri gas to South Eastern Europe, but faces numerous challenges related to its geopolitical nature. These include the lack of access to significant gas resources, security related risks along its route and geopolitical competition from Russia and China.

- The EU can reduce its exposure to external supply shocks by pursuing market integration and a more ambitious agenda focusing on renewable energy and energy efficiency, which will decrease its reliance on fossil fuels.

Introduction: the role of gas in the EU’s energy agenda

The European Union is heavily dependent on the import of natural gas. Gas consumption constitutes approximately 21% of the EU’s energy mix, where it is second only to oil (which amounts to approximately 34% of EU gross inland consumption).1 The significance of gas varies among EU member states. It plays an important role in the energy mix of several large members, such as Germany, Italy and the United Kingdom, and in several East-Central European countries. The former have a fairly diversified portfolio of sources and back-ups, whereas the latter tend to be much more dependent on a single supplier (Russia) and do not have substantial back-ups for gas in the sectors where it is used (for instance, in heating).

While in terms of volumes, EU gas consumption peaked in the late 2000s (reaching 447 million tonnes of oil equivalent, Mtoe) and subsequently decreased for a few years (it was 358 Mtoe in 2015), gas continues to be an essential energy source for the Union, particularly in sectors such as electricity generation and heating.2 As gas pollutes less than oil and coal, it is envisaged to play an important role in Europe’s transition towards a low-carbon economy, both as a replacement for dirtier fossil fuels and as a back-up for intermittent renewable energy production. The planned phase-out of nuclear power production in some member states – most notably in Germany, the main industrial producer in the EU, which will close all its nuclear power plants by 2022 – further adds to the relevance of gas.

While EU gas consumption has decreased recently, a simultaneous reduction in domestic gas production has occurred, which is due primarily to the depletion of North Sea fields. Hence, EU import dependency on gas grew from around 57% in 2005 to over 67% of total gas consumption in 2014.3 As this trend is expected to last, the European Commission has paid increasing attention to the security of its gassupply.4 In particular, the Commission would like to diversify gas suppliers by building new import infrastructure. This briefing paper examines the Southern Gas Corridor, one of the key projects that the EU has supported as part of its diversification agenda. It explores both the economic and the geopolitical challenges faced by the project and provides an assessment of its impact on EU energy security. In this context, it also illustrates its potential competition with the Turkish Stream project, which is sponsored by the Russian state company Gazprom. Finally, the paper analyses some options for the EU to strengthen its resilience to external supply shocks and reduce dependence on imported fossil fuels.

EU gas imports and challenges to the security of supply

As of 2016, the EU has imported its natural gas mostly via pipelines and from three producing countries and regions: Russia, Norway and North Africa. In 2014, Russia provided over 37% of EU imports, followed by Norway (31.6%) and Algeria (12%). Liquefied natural gas (LNG), transported by tankers at sea, offers an additional import option. The main supplier of LNG to Europe, Qatar, came fourth in the list of gas providers, covering nearly 7% of total EU gas imports.5 LNG imports have been constrained for a long time by higher prices compared to pipeline gas, the competition from other importers (especially in East Asia) and the large distances to producing regions. Following the US shale gas revolution, which is bringing additional LNG to international gas markets, the picture may partly change and LNG could increase its share of EU imports.

Currently, the European Commission supports additional import pipelines that would allow the diversification of suppliers. As large gas reserves are located in Central Asia, particularly in Turkmenistan and Iran, the EU has long attempted to gain direct access to these resources. An important stimulus for diversification came in the 2000s, from the combined effect of EU enlargement and the Russian-Ukrainian gas transit crises of 2006 and 2009. While enlargement meant the inclusion of new member states that were both vulnerable to Russian gas imports and anxious to diversify their suppliers, the gas transit crises called into question the reliability of Russia as a supplier and of Ukraine as a transit state. Russia’s answer to this conundrum came in the form of pipelines that bypass Ukraine, most notably Nord Stream (built in 2011–12), Nord Stream-2 and Turkish Stream (not yet built). On the other hand, the EU focused on integrating its domestic market (that is, interconnecting national markets and advancing common regulatory legislation) and creating a Southern energy corridor that would link it to Central Asian producers and bypass Russian territory.6

A large-scale EU project to tap into Central Asian gas, the Nabucco pipeline, failed in 2013 due to unfavourable market conditions and the Union’s ultimate inability to secure sufficient supplies. After the 2014 Ukraine crisis, however, the EU has revived its plans for a smaller (in terms of volumes) Southern gas corridor. The Commission has given priority to its implementation in both the Energy Security Strategy (2014) and in the Energy Union package (2015).7 Furthermore, EU officials have engaged in energy diplomacy in producing countries in an attempt to secure gas supplies for the project.

The Southern Gas Corridor

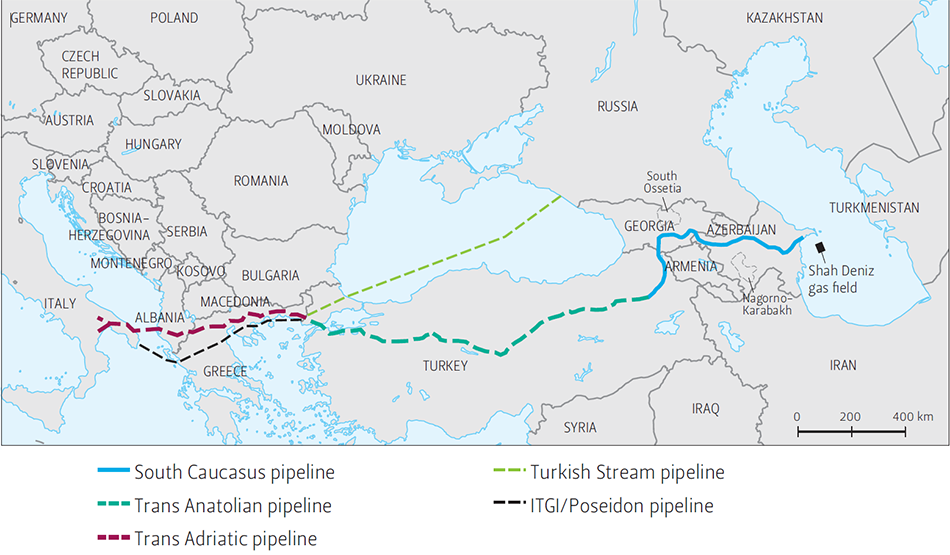

The Southern Gas Corridor (SGC) is currently under construction and consists of four sections, bringing gas from the Azeri fields in the Caspian Sea to Turkey, Greece and Italy. Its total length is approximately 3,500 kilometres, with an estimated construction cost of 45 billion dollars. The first section includes the Shah Deniz-2 gas field and extraction facilities in the Caspian Sea. The second part foresees the expansion of the existing South Caucasus pipeline, running from Baku to the eastern Turkish city of Erzurum. From Erzurum, the gas will be transported westwards by the Trans-Anatolian pipeline (TANAP), stretching as far as the Greek-Turkish border. Here, the fourth and last section of the SGC – the Trans- Adriatic pipeline (TAP) – will carry the gas across Greece, Albania and the Adriatic Sea to Italy.

The project is expected to start gas deliveries in 2020 and reach a capacity of 16 billion cubic metres per year (bcm/y) by the mid-2020s. Out of these volumes, 6 bcm/y are already contracted for sale to Turkey, while the remaining 10 bcm/y will be sold in the EU. These volumes are more modest than the ones envisaged for the Nabucco pipeline, which was expected to transport 31 bcm/y of gas to the EU, and will not significantly diversify European imports. They can, however, provide an additional gas source for those countries that are crossed by the SGC. For this reason, the EU has endorsed the project after the failure of Nabucco. The United States vocally supports the SGC too, as it regards it as an opportunity to decrease the dependence of South Eastern Europe on Russian gas imports. As of 2017, Russia is the main external gas provider to the region. The flow of Russian supplies largely depends on the Ukrainian transit pipelines, but Russia is developing alternative routes – most notably Turkish Stream – in order to bypass it in the near future.

Advocates of the SGC have argued that the volumes of exports could be doubled to 32 bcm/y in the future if additional gas becomes available. In fact, this appears an unlikely prospect, unless more infrastructure is built to connect the SGC to other potential suppliers, notably Turkmenistan and Iran. This would involve additional infrastructural costs that would question the economic competitiveness of the imported gas.8 Moreover, for the import of Turkmen gas, an offshore pipeline crossing the Caspian Sea would have to be built, an endeavour that is complicated by the uncertain legal status of the sea and the opposition of Russia and Iran (both are riparian states) to the project.9

The Southern Gas Corridor

SGC vs Turkish Stream?

While the SGC in its current shape will not have a significant impact on Russia’s position as Europe’s main gas supplier, its geopolitical dimension and its potential (though unlikely) future expansion have prompted a policy response from Moscow. Russia has pushed forward its own plans for further supplies to Turkey and South Eastern Europe, thereby strengthening the expected competition with SGC gas. In October 2016, the Russian and Turkish government signed the intergovernmental agreement for the construction of the Turkish Stream pipeline, which includes two lines of 15.75 bcm/y each connecting Russia and Turkey under the Black Sea. The first line will allow Russia to redirect its gas exports to Turkey, which are currently transported via Ukraine and the Balkans. This means that Russian gas exports to Turkey (the second largest customer of Gazprom after Germany) will no longer depend on transit in Ukraine and other countries.

The construction of the second line of Turkish Stream, which is meant for exports to South Eastern Europe, depends on broader market, political and infrastructural developments. If the construction of Nord Stream-2 is delayed or cancelled, or if plans to expand the SGC materialise, Gazprom will probably build the second line of Turkish Stream (parallel to the first one, but extending to the Greek-Turkish border). This would allow the company (and the Russian government) to compete in order to retain its market shares (and soft power) in the region. Turkish Stream could then supply Italy, a large gas consumer and hence a coveted market by both Gazprom and the SGC stakeholders. As of 2015, Italy was Gazprom’s third largest national customer. The Russian-Italian gas trade relied on Ukrainian transit pipelines. As Gazprom appears reluctant to depend on Ukrainian transit in the long run, Turkish Stream could eventually become the main route via which Russian gas is shipped to Italy.10

The potential competition between the gas transported by the SGC and Turkish Stream becomes evident if the adjoining pipelines on EU territory are analysed. As discussed earlier, the SGC will rely on the TAP pipeline for the transportation of 10 bcm/y of gas from the Greek-Turkish border to Italy. For this capacity, TAP has obtained an exemption from EU rules concerning third party access, which limit the capacity that one supplier can use; thanks to the exemption, the Shah Deniz consortium can use the entire pipeline. On the other hand, Gazprom would rely on the ITGI/Poseidon pipeline for the transportation of its gas from the Greek-Turkish border (where Turkish Stream ends) to Greece and Italy. For this purpose, in February 2016 the Russian company signed a memorandum of understanding with the Greek company DEPA and the Italian Edison, which are in charge of developing ITGI/Poseidon.

Contrary to the South Stream project, Gazprom would thus not control the ‘extensions’ of Turkish Stream on European territory, which eases regulatory issues. The EU has already classified ITGI/ Poseidon as a Project of Common Interest and given a 25-year exemption from the rule on third party access, meaning that Russian gas could use the entire capacity of the pipeline. Moreover, if the capacity of the TAP pipeline is expanded in the future (as often mentioned by its advocates), Gazprom could apply to have additional gas transported via the new TAP capacity, which is not exempted from the rule on third party access. Ironically, this would mean that TAP, an EU import diversification project, might end up carrying Russian gas too.11

Geopolitical challenges to the SGC

The competition between the SGC and Turkish Stream illustrates how an EU-driven geopolitical project has been met by a Russian response in the geopolitical playing field. While both projects partly respond to a market logic (diversifying imports for the EU, defending its market position for Gazprom), geopolitical considerations are a key driver for their implementation. For the EU, the main risk of a geopolitical approach to energy involves challenging Russia, as well as other competing actors (such as China), in a field where they are particularly resourceful. Ultimately, the success of EU diversification projects such as the SGC depends on securing access to resources that are located in Central Asia. A closer look at the geopolitics of this area reveals that competition from infrastructural projects such as Turkish Stream is only the tip of an iceberg of challenges for the EU.

While the SGC has secured access to the Azeri gas field of Shah Deniz-2, its resources are limited and will not allow significant import diversification for the EU. Access to Turkmen and Iranian gas is constrained by the economic and legal issues mentioned above. Most significantly, China has already built the infrastructure to import large quantities of Turkmen gas and tied the Turkmen government to long-term deliveries in exchange for multibillion-dollar loans. Hence, the EU faces strong Chinese competition for access to these gas reserves. On the other hand, if relations between the West and Iran remain positive and international investments in the Iranian gas sector are made, the EU might be able to purchase Iranian gas. However, if this scenario materialises, it is more likely that Iranian gas will be imported by sea in the form of LNG (rather than via a pipeline), as this would allow avoiding the costs and security risks of a long land route.

Even without an extension to Iran or Turkmenistan, the SGC already faces considerable security issues, which are related to the volatility of the South Caucasus. Following the route of the pipeline East to West, the first major source of uncertainty concerns the Nagorno-Karabakh conflict between Armenia and Azerbaijan. Nagorno-Karabakh is a de facto independent region controlled by the Armenian army, which occupied it (together with some adjacent Azeri territories) following the disintegration of the Soviet Union. The conflict has been frozen ever since, but with regular skirmishes and casualties on both sides. Moreover, Azerbaijan has been using its large revenues from oil and gas sales to modernise its army, with the hardly concealed objective of eventually reconquering Nagorno-Karabakh by force.

The conflict zone is only a few kilometres away from the South Caucasus pipeline, the local section of the SGC. In preparation for a potential conflict with Azerbaijan, in February 2016 Armenia purchased Russian military hardware, including advanced missile systems. Moreover, the Armenian air force has also simulated attacks on Azerbaijan’s energy infrastructure. In early April 2016, heavy fighting took place along the Armenian-Azeri contact line in Nagorno-Karabakh. The clashes lasted four days, and a wider conflict was avoided; however, the events highlighted the risk of a major conflagration in the area.12

Moving along the SGC route westwards, the pipeline crosses two additional areas that have proved to be volatile in the recent past. In Georgia, it lies within easy reach of South Ossetia, another de facto state that has been recognised by Russia since the 2008 Russian-Georgian war and which hosts Russian troops. During the 2008 conflict, the Russian army reached the Georgian transit pipelines, some of which had to be closed temporarily due to security risks. Further to the west, the SGC transits Turkish territory where clashes between the Turkish military and Kurdish militias have taken place in the past. Such clashes escalated in the summer of 2015 when the Turkish armed forces resumed their military operations against the Kurds. In August 2015 an explosion occurred on the Turkish section of the South Caucasus pipeline, for which the Turkish press blamed the Kurdistan Workers’ Party (PKK).

What options for Europe? The regulatory and climate approach

Given the multiple security and economic challenges to the SGC, its actual contribution to European energy security remains dubious. The SGC would have a substantial impact on the diversification of EU gas imports only if it secured additional supplies from Central Asia, which would require a much stronger EU strategic presence in the region. However, the EU appears unlikely to emerge successful from the ensuing geopolitical competition, which would involve militarily or economically stronger regional players (Russia and China) and a high degree of volatility. Moreover, the need to establish a partnership with producing countries, most notably with authoritarian regimes such as Azerbaijan and Turkmenistan, questions the EU’s proclaimed commitment to promoting norms and democratic values.

On the other hand, pursuing the integration of the internal energy market seems to be the most promising path to strengthening EU energy security. This is an area where the EU has already made considerable progress thanks to recent legislation – in particular the third energy package, which aims at increasing the competitiveness, sustainability and supply security of the electricity and gas market. In order to strengthen its resilience to external shocks, the EU should support the interconnections of the energy systems of its member states. As building additional infrastructure will be costly, the financial commitment of member states is required, especially of those that have not yet managed to diversify their import portfolios and are particularly concerned about dependence on external suppliers.

It is important to note that, in the field of natural gas, EU import capacity already exceeds import needs. In 2012, capacity was 597 bcm/y (405 bcm/y through pipelines and 192 bcm/y through LNG import terminals) whereas EU annual gas consumption needs were approximately 435 bcm/y.13 Interconnections among member states may thus allow access to the currently stranded (unused) import capacity. An integrated and well-regulated EU energy market would constitute the world’s largest single export market for energy producers, who would thus be stimulated to compete in order to secure their shares.

While market integration can help reduce the costs and risks of external energy dependence, reducing energy consumption – and particularly fossil fuel consumption – appears to be the only way of progressively solving the EU’s energy conundrum. This can be achieved by increasing the share of renewables in the energy mix and by strengthening energy efficiency. The EU has set targets in these areas for the years 2020 and 2030. By 2020, the EU is expected to cut greenhouse gas emissions by 20% (from 1990 levels), produce 20% of its energy from renewables and improve its energy efficiency by 20%. For 2030, the European Commission has already set a 40% goal for the reduction of greenhouse gas emissions, but targets for renewables (27%) and energy efficiency (27%) appear modest if the Commission’s goal of achieving a low carbon economy by 2050 is used as a benchmark.

Paradoxically, some member states that are most concerned about external energy dependence and most affected by fossil fuel-related pollution are the staunchest opponents of an ambitious climate agenda. The case of Poland is particularly striking. According to the World Health Organisation, the country has 33 of the 50 worst polluted cities in Europe due to its large-scale reliance on coal. Moreover, the Polish government has often lamented the EU’s excessive dependence on fossil fuels imported from Russia. Nevertheless, in order to defend the domestic coal industry, Warsaw has consistently opposed ambitious climate targets, which contributes to perpetuating Europe’s dependency on fossil fuel imports.

While the EU strengthens the integration of its internal market and pursues its climate agenda, it can also translate its related domestic achievements into a successful external energy policy vis-à-vis neighbouring countries. The recent past has shown that ‘rule export’ is indeed the field in which the Union’s external energy policy has been most successful. Through the establishment of the Energy Community, the EU has managed to extend its acquis communautaire on energy, environment, competition and renewables to some of its Eastern and South Eastern European neighbours (Ukraine, Moldova and the West Balkan countries). The Energy Community provides for mutual assistance at times of stress and contributes to the resilience of countries that are important (for instance, as transit states) for EU energy policy.

What next? A norm-based transition to a low carbon economy

In the short and medium run, the EU will continue to rely on large imports of energy, including natural gas. However, the EU can considerably influence the extent, duration of and approach to this dependence. Investments in domestically produced renewable energy and in energy efficiency would reduce both the extent and the duration of the Union’s dependence on fossil fuel imports. Moreover, the ensuing reduction in greenhouse gas emissions would have positive effects on air pollution, which has reached preoccupying levels in many European cities. Simultaneously, market integration will strengthen the energy resilience of individual member states.

As long as the EU needs to import fossil fuels from abroad, a pragmatic approach towards its main external providers will be necessary. This is particularly important when it comes to the Union’s main external supplier, Russia. While the Ukraine crisis has understandably heightened the concerns of member states that are more vulnerable to supply disruptions from Russia, a major gas transit crisis (such as that of 2009) has been avoided.14 In 2014, the early warning mechanism between Russia and the EU (created in 2009) functioned and EU member states were able to take the necessary action to secure gas deposits in underground storage facilities.15 In fact, the EU has even managed to supply gas to Ukraine by redirecting its own imports of Russian gas. Hence, the EU has an interest in preserving the institutional framework that regulates its energy trade with Russia and in pursuing a rule-based relationship.

Furthermore, the EU’s external energy policy will benefit from a domestic legislative framework that promotes the Union’s decarbonisation and competition among its external energy suppliers. Resilience to external shocks affecting energy supplies is best pursued through the overall reduction of fossil fuel dependence, the integration of the internal energy market and reliance on stranded import capacity (such as LNG terminals). Conversely, geopolitical projects such as the Southern Gas Corridor involve large investments that lock the EU into fossil fuel dependence. Moreover, they push the Union towards geopolitical competition with traditional geopolitical actors, such as Russia and China, with meagre chances of concretely contributing to its energy security.

Notes

1 EU energy in figures, Statistical pocketbook 2016.

2 Eurostat, energy statistics, available at http://ec.europa.eu/eurostat/web/energy/data/database, last accessed 28 Feb 2017.

3 EU energy in figures, Statistical pocketbook 2016, p. 24.

4 The Commission shares competences in the field of energy policy with member states (see Article 194 of the Treaty on the Functioning of the European Union).

5 EU energy in figures, Statistical pocketbook 2016, p. 26.

6 See M. Siddi, The EU-Russia gas relationship: New projects, new disputes?, FIIA Briefing Paper 183 (2015), available at http://www.fiia.fi/en/publication/533/the_eu-russia_gas_relationship/, last accessed 28 Feb 2017.

7 See M. Siddi, “The EU’s Energy Union: a sustainable path to energy security?”, The International Spectator 51 (1), 2016.

8 See S. Pirani, Azerbaijan’s gas supply squeeze and the consequences for the Southern Corridor, Oxford: Oxford Institute of Energy Studies, July 2016.

9 See M. Verda, “The Foreign Dimension of EU Energy Policy: The Case of the Southern Gas Corridor”, in J. M. Godzimirski, ed. (2016), EU Leadership in Energy and Environmental Governance, London: Palgrave, pp. 69–86.

10 See also M. S. Vicari, “TurkStream and its second line: challenge for some, opportunity for others”, Vocal Europe, 17January 2017.

11 See also I. Gurbanov, “Perspective for Turkish Stream project: possible scenarios and challenges”, Natural Gas Europe, 21 January 2017.

12 For background details on the Nagorno-Karabakh conflict and the April 2016 clashes, see L. Broers, The Nagorny Karabakh Conflict: Defaulting to War, London: Chatham House, July 2016.

13 S. Schubert et al. (2016), Energy Policy of the European Union, London: Palgrave, p. 225.

14 A. Stulberg (2015), “Out of gas? Russia, Ukraine, Europe, and the changing geopolitics of natural gas”, Problems of Post-Communism, 62:2, pp. 112–130.

15 A. Belyi (2015), Transnational Gas Markets and Euro-Russian Energy Relations, Basingstoke: Palgrave, p. 151.

About the Author

Marco Siddi is a Senior Research Fellow for the European Union Research Programme at the Finnish Institute of International Affairs.

For more information on issues and events that shape our world, please visit the CSS Blog Network or browse our Digital Library.